We took a close look at five New Yorkers’ food and drink habits to see where the effects are most felt.Įsther L. Cost of Living: As food prices rise, eating is becoming increasingly expensive.Now, it’s going to affect the size of your paycheck next year. Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet.has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills. Answer these seven questions to estimate your personal inflation rate. Inflation Calculator: How you experience inflation can vary greatly depending on your spending habits.Understand Inflation and How It Affects You The nonpartisan office warned last year that rising interest costs and growing health spending as the population aged would increase the risk of a “fiscal crisis” and higher inflation, a situation that could undermine confidence in the U.S. The total debt held by the public outpaced the size of the American economy last year, a decade faster than forecasters projected. In January 2020, before the pandemic spread across the United States, the Congressional Budget Office projected that the gross national debt would reach $30 trillion by around the end of 2025.

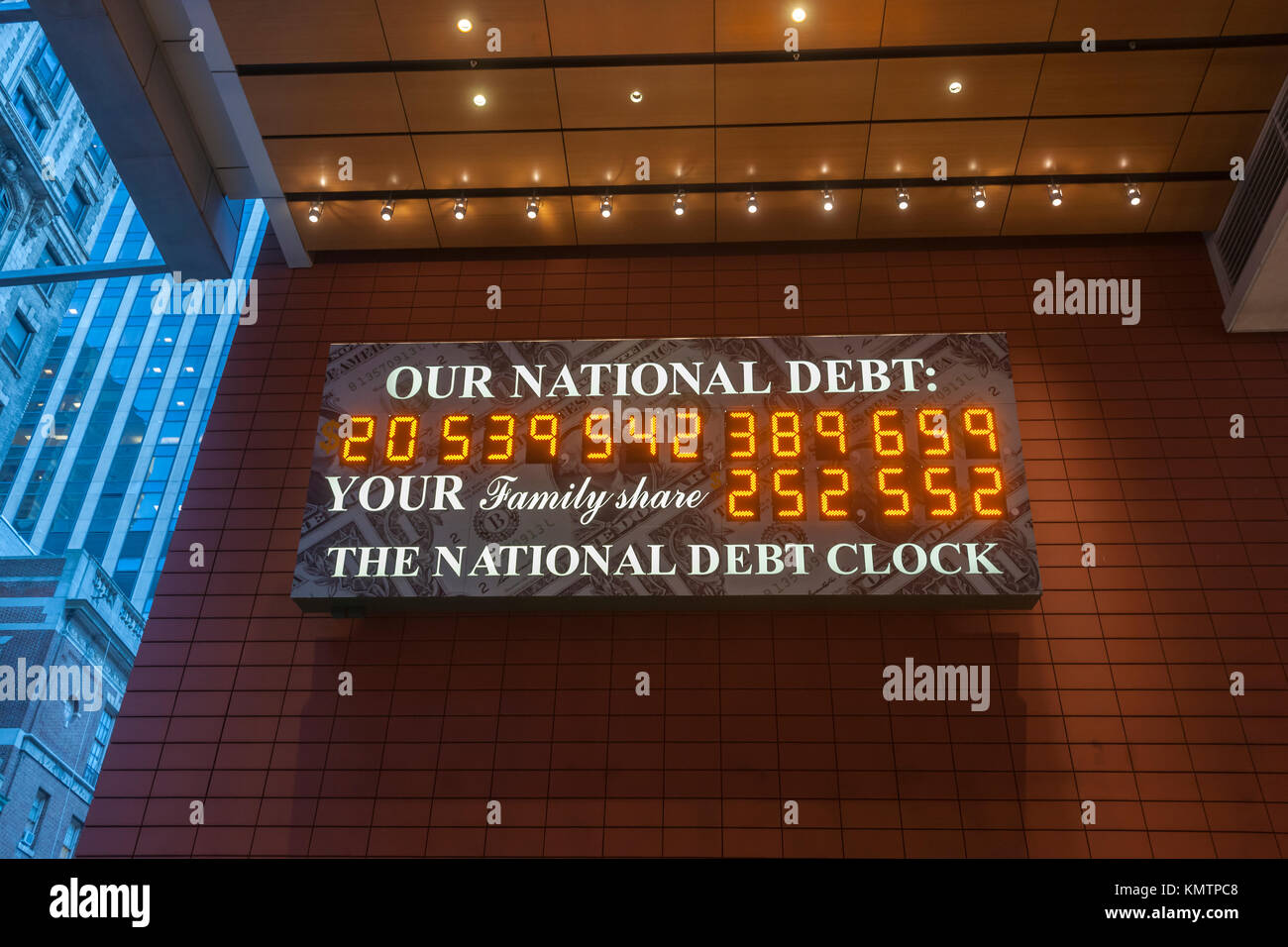

After a protracted standoff in which Republicans refused to raise America’s borrowing cap, threatening a first-ever federal default, Congress finally agreed in December to raise the nation’s debt limit to about $31.4 trillion. Biden for putting the nation on a rocky fiscal path by funding his agenda. While Republican lawmakers helped run up the nation’s debt load, they have since blamed Mr. During the Trump administration, most Republicans ceased to be fiscal hawks and voted along party lines in 2017 to pass a $1.5 trillion tax cut along with increased federal spending. Renewed concerns about debt and deficits in Washington follow years of disregard for the consequences of big spending. The gross national debt represents debt held by the public, such as individuals, businesses and pension funds, as well as liabilities that one part of the federal government owes to another part. Those securities allow the government to borrow money relatively cheaply and use it to invest in the economy. Treasury securities, which gives them safe assets to help manage their financial risk. Some economists contend that the nation’s large debt load is not unhealthy given that the economy is growing, interest rates are low and investors are still willing to buy U.S. The borrowing binge, which many economists viewed as necessary to help the United States recover from the pandemic, has left the nation with a debt burden so large that the government would need to spend an amount larger than America’s entire annual economy in order to pay it off. That $5 trillion, which funded expanded jobless benefits, financial support for small businesses and stimulus payments, was financed with borrowed money. The breach of that threshold, which was revealed in new Treasury Department figures, arrived years earlier than previously projected as a result of trillions in federal spending that the United States has deployed to combat the pandemic. WASHINGTON - America’s gross national debt topped $30 trillion for the first time on Tuesday, an ominous fiscal milestone that underscores the fragile nature of the country’s long-term economic health as it grapples with soaring prices and the prospect of higher interest rates.

0 kommentar(er)

0 kommentar(er)